Total take-up reached 21.2 million sq ft over the first half of 2022, down 14% on the record-breaking 24.8 million sq ft in H1 2021.

The market is under supplied, prompting a 1.2% average monthly rental growth in June. London assets outperformed the rest of the UK at 1.6%.

Yields stabilised in June and Colliers has witnessed price reductions / negotiations on very recently agreed investment deals.

Demand

- Take-up activity for warehouse space over 100,000 sq ft reached 10.1 million sq ft in Q2 2022, taking it to 21.2 million sq ft over the first half of the year, only 14% below the record-breaking 24.8 million sq ft in H1 2021. Against a challenging economic backdrop, with inflation eroding business margins and real household income, occupiers continue to remain highly acquisitive.

- Third party logistics (3PL) firms drove up demand in the first half of the year, accounting for 40.5% of take-up. This is partly in response to an increased need for flexibility from businesses, arising from economic uncertainty. Online shopping continues to be popular despite rising inflation levels and interest rates, creating a ‘perfect storm’ for the rise of 3PL take-up. On the other hand, pure-player retail take-up reached a 13.6% share, down from 52.2% recorded over the same period last year when Amazon alone took 35% of the total take-up. Therefore, occupier activity remains relatively broad-based across a variety of sectors, supporting overall demand and the resiliency of the sector.

- The number of deals agreed on larger and more efficient warehouse space is at an all-time high, with units sized 300,000 sq ft + recording 26 deals (H1 2022) compared with 23 and 20 deals transacted over the same period 2020 and 2021, respectively. The demand rate recorded for warehouse space between 100,000 sq ft and 200,000 sq ft was the third highest activity in the first half of the year at 48 deals. This follows on from H1 2021 (67 deals) and H1 2019 (53 deals).

- Occupiers are increasingly targeting Grade A space due to the lack of existing second hand units, a drive to reduce costs and increase operational efficiency while reducing their carbon-footprint. As a result, demand for new units continued unabated over the first half of the year, with take-up for purpose-built space accounting for 52% of total take-up, whilst speculative space recorded a 31% share.

UK take-up by type of unit

Source: Colliers - Note: Occupier deals 100,000+ sq ft

Take-up by size band (N. of deals)

Source: Colliers

"This historic low level of supply is preventing the market from functioning properly, making it very challenging for occupiers to satisfy requirements. As a result, this is fuelling strong rental growth across the board."

Len Rosso

Head of Industrial & Logistics, Colliers

Supply and rents

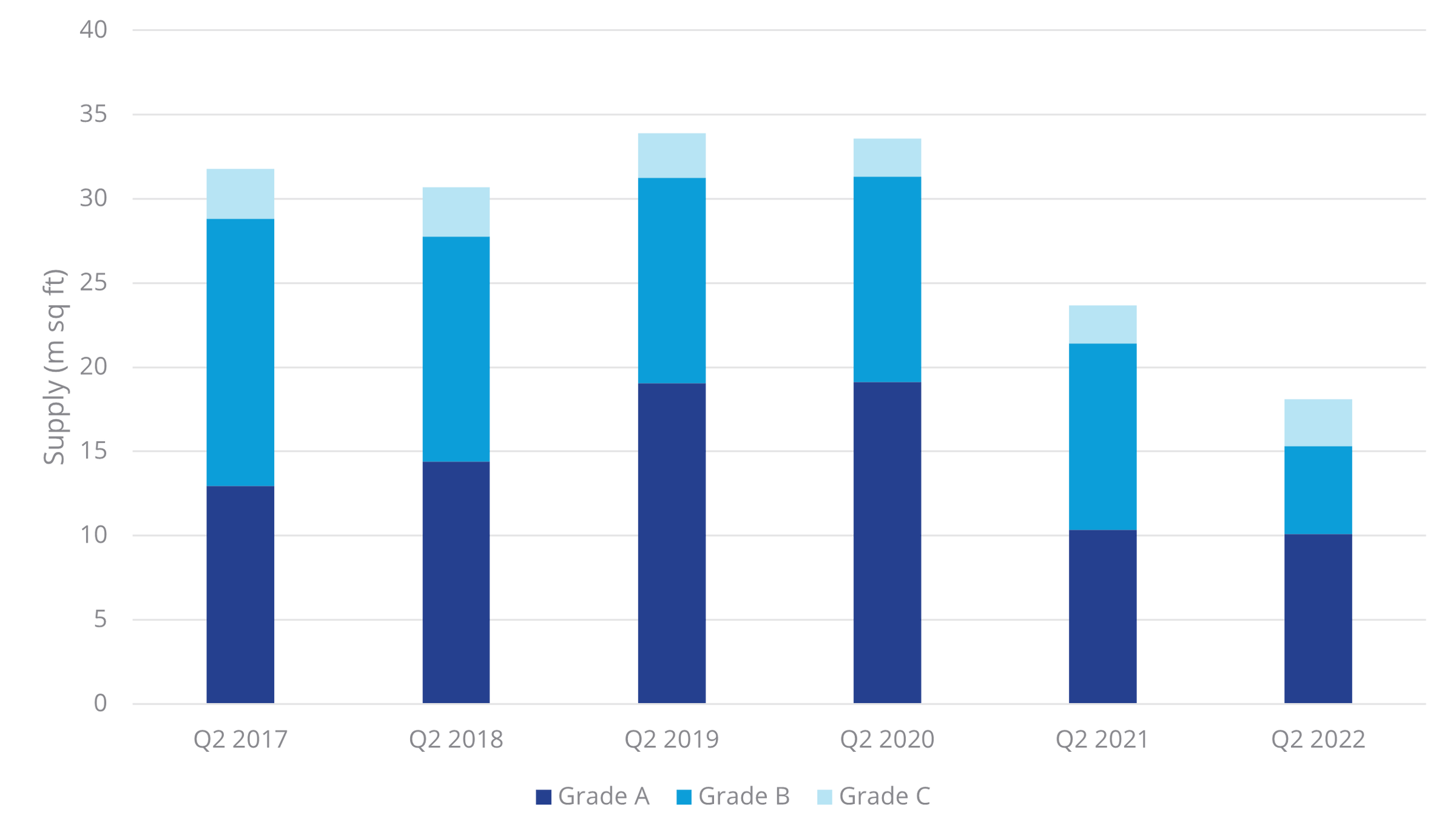

The market is heavily under-supplied with the latest data as of Q2 2022 showing a total supply of 18.2 million sq ft, which includes speculative space expected to complete in Q3. Down 20% y/y, this leaves the market with less than six months’ supply.

Development activity to provide new space is robust and Colliers is recording a further 3.4 million sq ft due to be delivered over the remainder of 2022. However, there’s no doubt that the creation of new supply is struggling to keep up with strong occupier appetite for warehouses. These tensions are set to become even more strained as occupiers seek to reduce their carbon footprint, increasingly looking for new space that aligns with their ESG agenda.

Because of this supply/demand imbalance and strong occupier demand, rents are continuing to rise, with the latest June MSCI average rental growth for distribution warehouses across all sizes and grades topping 1.2% m/m (6.3% six-monthly). Standard industrial assets recorded similar rates of rental growth with London and South East assets reaching 1.6% m/m (9% six-monthly) and 1.2% m/m (6.7% six-monthly) respectively.

UK supply (m sq ft)

Source: Colliers - Note: Warehouses 100,000+ sq ft

"Yields have stabilised due to the rise of the cost of financing across major economies. It would not be surprising if a yield adjustment occurred over the reminder of the year."

Andrea Ferranti

Director, Research, Colliers

The investment market witnessed a slowdown in Q2 2022 when it recorded £1.6 billion (PropertyData) transacted, taking the first half of the year to £6.2 billion. While this is a contraction of 22.4% over the record level seen over the same period in 2021, the sector remains attractive to investors as occupational supply and demand dynamics and future rental growth prospects will sustain potential returns and pricing.

Nevertheless, investment sentiments across UK real estate assets have been dented by the recent sharp increases of the cost of financing both in the UK and in the United States, with high inflation and a challenging geopolitical environment ending more than a decade of mostly expansionary monetary policy across major economies. The Federal Reserve is normalising its monetary policy more aggressively than the Bank of England, hence driving the cost of US denominated debt much higher. The US 10-year Treasury Yield stood just below 3% at the time of writing, whilst the 10-year UK Gilt Yield was at 2%.

Yields stabilised in June 2022 when MSCI reported average UK Equivalent Yields for Distribution Warehouses at 4.28%. There has been some froth reduction due to less competitive bidding in the market and it would not be surprising if a yield adjustment occurred over the remainder of 2022. We have seen some price reduction/negotiation on very recently agreed deals. Investment opportunities with reversionary potential and value-add are expected to remain high on investors’ wish lists with core assets to be scrutinised more intensively as the cost of debt erodes margins. Over the short term, investors will struggle to maximise returns for some capped and collared investments as CPI is expected to peak at 10% in Q4 2022 (Bank of England).

The number of investors targeting industrial assets is inevitably shrinking but cash-rich, long-term holders and those investors with a secured line of credit will continue to remain very active in search of opportunities. The sector fundamentals remain healthy, driven by the robust occupational demand and the low supply which will continue to drive rental growth for the foreseeable future.

UK industrial investment volumes (£ '000)

Source: Property Data

MSCI industrial equivalent yields

Source: MSCI

Click here to learn more about our Industrial & Logistics services, latest research, videos and events

Andrea Ferranti

Copyright Colliers 2022 | Privacy Policy | Terms of use